The economic pressure, inflation and devalue of currency in Zimbabwe have its traces from the past. The unparalleled inflation in the history of Zimbabwe took place in the year 2008, where 79.6 billion percent of hyperinflation happened every month. The currency of Zimbabwe became a valueless one and was forced to abandon in 2009 in favour of the US dollar. The influence of the US dollar limited the monetary policy of Zimbabwe.

- 2016 – Through bond notes the domestic currency was reintroduced. The currency shortage led to hyperinflation again.

- 2019 – Zimbabwe dollar reacquainted but the value is eroded.

- 2020 – Again the currency instability hitted the country.

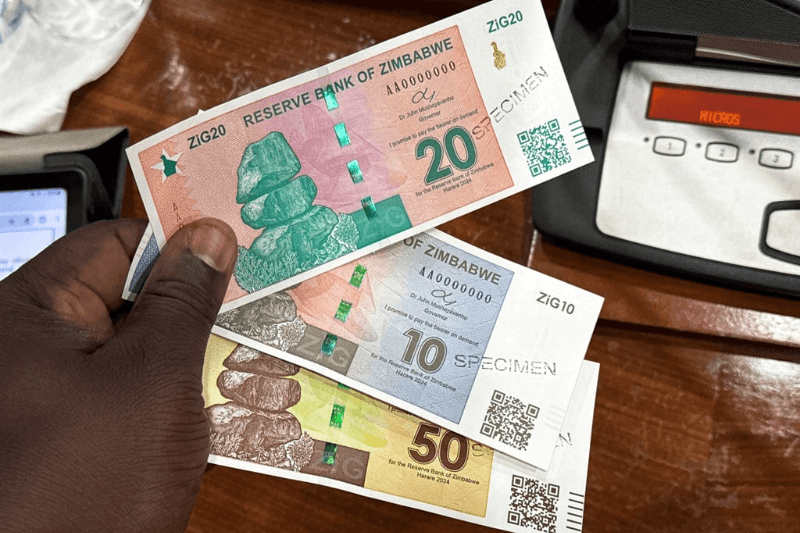

Zimbabwe Gold-backed currency (ZiG)

The golden-backed currency of Zimbabwe (ZiG), off-course from the initial attempts of stabilising their country’s economy due to high inflation. On April 5, 2024, the Zimbabwe government launched this new currency aiming to diminish the dependency of US dollars. They failed to battle strongly against their rising inflation and economic pressures every year.

Reasons Why it happened?

The Reserve Bank of Zimbabwe deducted the value of ZiG to 43 percent, on September 27. To the US dollar the value of ZiG was taken from 13.56 to 24.4 ZiG. This resulted in the further weakening of the Zimbabwe currency. The money flow was forced between official and unofficial rates of ZiG currency. The value of ZiG was twice higher in the black market, than what it was approved for. The gap between the rates of ZiG & Zim Dollars continued. The uneven rates of the currency required laborious trade by the local businesses and retailers.

1 US dollars = 30,000 to 40,000 Zim Dollars

Former President Robert Mugabe criticised that the longtime economic pressure and hyperinflation was due to the mismanagement, corruption and sanctions by the US and the International Monetary Fund (IMF). This reflected even in the basic food rate, that is a loaf of bread at the most expensive cost 500 million Zim Dollars. It sucked the savings and pensions of common people.

The Statement of Governor of RBZ

“It was not a devaluation but a manifestation of what was already happening on the market.

I’d say that the impact…. Has been felt, but there should be stabilisation going forward. In fact, we should see prices starting to fall.” said John Mushayavanhu, Governor of RBZ.

Keep Reading

Unclear Future Economy

“I don’t think we are seeing the death of the currency, but we have work cut out for us. We have to do more work in terms of convincing the citizens that the money is stable” said the President of the Bankers Association of Zimbabwe.

The people of Zimbabwe are in confusion with their currency values variations. Despite the crisis, the government agencies are instructed to distribute the pensions and salaries in both ZiG and the US dollars. Civil servants salary and annual bonus will be in US dollars(this year). But this unclear decision still continues between both the government and the common citizens.