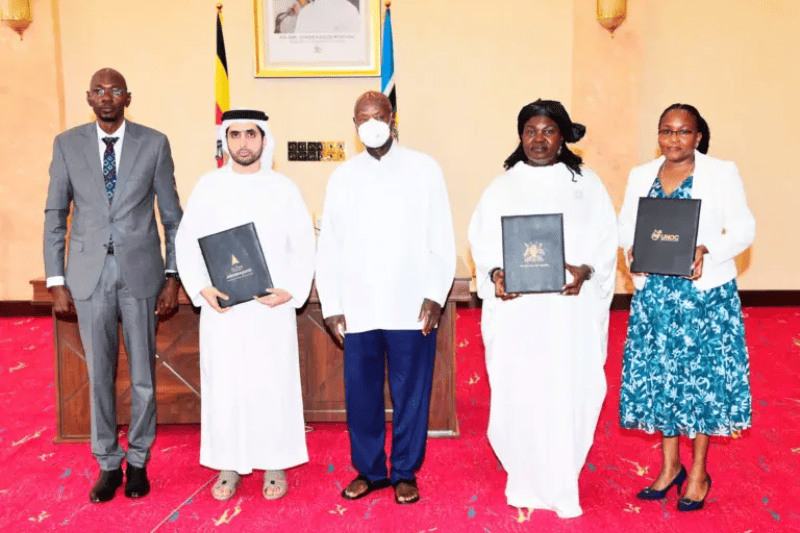

The signing of a $4 billion agreement with Dubai-based Alpha MBM Investments to build a 60,000 barrels-per-day oil refinery marks a new chapter in Uganda’s oil journey, as it is the most significant milestone in the last 13 years in Uganda’s quest for a credible investment partner. The agreement unlocks value to Uganda to realise energy sovereignty from its oil production, drive industrialisation and subsequently stimulate the national economy.

Fuel Security and Energy Independence

Uganda is currently spending close to $2 billion per year on fuel imports and because of this, Uganda considers the refinery a vital component of its long-term energy security. With the assurance of crude supply from the Tilenga and Kingfisher oilfields where UNOC has a 15% interest, the refinery will provide an avenue to secure oil from Uganda.

This encourages stable business relations and potential investments of fuel exporters. Furthermore, the refinery provides domestic support if international crude oil prices rise, meaning Uganda exposure less to exposure on fluctuating international fuel price increases, plus, the refinery provides the ability to build a stable, reliable and bankable energy market for itself.

Industrial Growth and Job Creation

The refinery alone is anticipated to contribute 9% to Uganda’s GDP, which could rise to 20% once the fully constructed Kabalega Industrial Park, containing petrochemical manufacturing, comes online. The project will create approximately 32,000 direct and indirect jobs as well as supports technical training, SMEs and broader industrial change.

Keep Reading

Regional Energy Diplomacy and the EACOP Link

The refinery offers Uganda the opportunity to be a regional energy hub, while also being linked with the East African Crude Oil Pipeline (EACOP). While there are no operational refineries in East Africa, Uganda could potentially provide refined fuel that is cheaper than imported refined product from the Gulf region, and potentially switch trade flows regionally to the benefit of its regional geopolitical influence.

Concerns over Transparency and Sustainability

While the deal’s promise demands it, questions have arisen. Alpha MBM Investments, relatively new to the game and short on experience with midstream oil infrastructure, plans to fully fund the $4B project through equity, a strange approach for larger projects. Environmentalists and civil society actors have also raised questions around community displacement, ecosystem risks, and transparency with the deal.

Engaging the Public with the Facts

As Uganda awaits its Final Investment Decision (FID), the public messaging on this deal will be important. Through infographics, interviews, and graphics based on data, stakeholders will need to communicate the benefits, risks and timelines of this deal to the public. This is about more than infrastructure; this is about transforming Uganda’s future energy position in Africa and the region is watching.