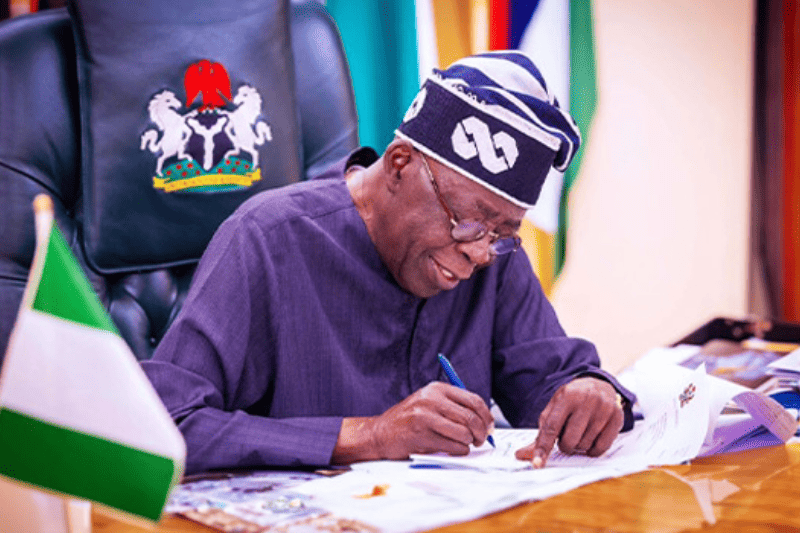

Nigeria has begun its landmark tax reform process with the creation of four new laws such as Nigeria Tax Act, Nigeria Tax Administration Act, Nigeria Revenue Service Act and Joint Revenue Board Act which will come into force on the 1st January 2026.

Consolidated and Simplified Tax System

The Nigeria Tax Act consolidates over 50 existing tax laws into one code by amalgamating taxes and avoiding multiple taxes on the same income or goods. It creates consistent authority rules from the three levels of government; “Whether you’re in Lagos or anywhere else, tax officers have to use the same criteria.”

Keep Reading

Relief for Low-Income Earners & SMEs

One of the key benefits is that the legislation exempts individuals from personal income tax, if they earn NGN 800,000 or less in an annual year. Small businesses, whose turnover is below NGN 100 million benefit from tax relief and simplified compliance, thereby encouraging formalisation.

VAT & Input Tax Reforms

While the VAT rate remains at 7.5%, the reforms zero rate basic goods and services associated with food, health, education, housing rent and public transport. The increased input VAT claims will mean no more double taxation and provide much needed support to business growth.

New Institutions & Tech Modernisation

The Nigeria Revenue Service (NRS) takes the place of FIRS by joining all federal tax and levies under one agency that is technology driven. A new Tax Appeal Tribunal and Office of the Tax Ombuds provide guarantees for taxpayer rights as well as a fair dispute resolution mechanism.